To set yourself up for success in retirement, it’s crucial to understand and address some of the major risks to your retirement portfolio.

Inflation Risk:

Inflation poses a significant threat to your retirement savings. Over time, the purchasing power of the dollar decreases, leading to higher costs. Many people underestimate the impact of inflation on their retirement income, planning only for the first few years without considering a retirement that could span two to three decades. If you need an annual income of $50,000 and assume a 3% annual increase in income to combat inflation the numbers below show how much is needed.

For a 20-year retirement:

– Total spending for a 20-year retirement: $1,282,258

For a 25-year retirement:

– Total spending for a 25-year retirement: $1,791,214

These numbers represent the total amount of money required for each retirement duration with the specified annual income and income increase and as you can see the extra 5 years adds more than 500,000 of needed income.

It’s essential to protect your retirement income from inflation by including a significant portion of stocks in your portfolio. Stocks have historically provided better inflation protection than fixed income products like savings accounts, CDs, and bonds.

Longevity Risk:

People tend to underestimate longevity risk, which is the risk of outliving your retirement income. With advancements in technology and healthcare, people are living longer, putting more stress on their retirement portfolios. The longer you live, the more money you require. Long-term care costs can also be substantial, and many individuals will require long-term care at some point in their lives. Preparing for longevity risk involves diversifying your retirement portfolio and deciding how to handle potential long-term care costs. You can either self-insure, meaning you have enough assets to cover long-term care, or purchase long-term care insurance (LTCI). The decision to purchase LTCI should be based on the potential impact of long-term care costs on your portfolio and the cost of premiums.

Sequence of Returns Risk

The order in which investment returns occur can significantly affect your retirement portfolio. Early returns are crucial, as they can influence the number of shares you must sell to generate income. Lower returns in the initial years of retirement can lead to depleting your assets more quickly, reducing your overall success rate. Properly structured portfolios can mitigate the impact of downturns on your investments by diversifying asset classes and allocating a significant portion to bonds. Maintaining flexibility in your income needs and having an emergency fund in retirement can also help protect against sequence of returns risk.

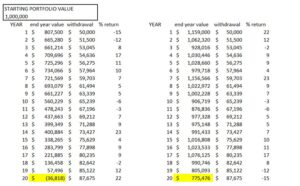

The table below shows an example of returns that happen in reverse order but have the same average return of 6%. Portfolio A runs out of money while portfolio B still has more than 700,000 left in year 20.

Sequence of return matters a lot when you are in the distribution phase and even though we can’t control market returns we do have the ability to diversify properly and to understand what risk and volatility our portfolio has so that we can adjust accordingly.

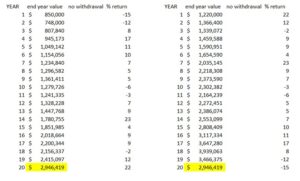

The next table below shows the same returns as example 1 but here there are no withdrawals and as can be seen by the end balance the sequence of returns do not matter when we are accumulating the same way it does when we are in a distribution phase of our investment life.

To get your free portfolio analysis and see where your portfolio volatility is at and see how your investments are diversified click here.

By addressing these three major risks and taking appropriate measures, you can enhance your prospects for a successful retirement. If you’d like to discuss your retirement plans further or need assistance, please feel free to schedule a call or meeting with us.

- Calculations assume withdrawal taken beginning of year and does not take into effect taxes. Returns are hypothetical to show a model of financial values and the impact in retirement.